The changing portuguese real estate market ( Part 3 )

Emerging sources of clients, supply versus demand imbalances and much more.

The chasm between cost and access to accommodation by local people, and the cost of delivering new inventory

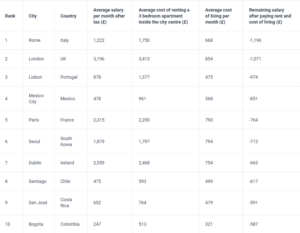

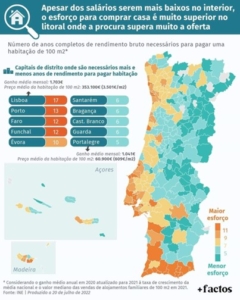

In a report by CIA Landlord Insurance in the UK, published in March 2022, Lisbon is ranked as the third least viable city in the world in which to live, if you are renting. This is due to the discrepancy between disposable income for local people, and the cost of housing.

The Portuguese government has no consistent policy to deliver new housing, much less affordable housing, on any scale. Delivery of Build to Rent, previously also known as PRS (private rental sector), inventory, is practically impossible due to, among other factors, the tax burden. At least 35% of the total cost of any new construction is tax (of which the most significant are: VAT of 23% on cost of construction; 1.23% VAT on sales agency commission; around 5-6% IMT; notary costs; fees and contributions, including compensatory payments, by developers to municipalities). This excludes the cost of bureaucracy and delay which are borne by investors as a reduction in returns, and may be transferred to end buyers via price increases.

Why will new build continue to increase in value (and price)?

In addition to the benefits of newer, more efficient, more environmentally considerate technologies and materials, all of which come at a price, there is also the cost related to the process of developing a new project. As comment by a senior executive at a leading real estate consulting firm in Portugal: challenges include “high property taxes, VAT, and the sheer time it takes to get planning permission from city halls and local councils. This, in turn, makes it impossible for developers that normally plan ahead by up to 10 years, to keep to their original costings and budgets, thereby scaring off investors in this particular residential housing segment.”

The Portuguese Property Survey (PIPS), produced by the magazine Confidencial Imobiliário and the APPII, in May of 2022, reported that there had been an “increase in construction costs of 18% over the past year”. This cost will have to be passed on, in part or in full, to the end buyer.

A combination of existing lack of product, low levels of new build, an increase in labour and materials costs, high tax and slow planning cycles, mean that it is impossible to deliver affordable new build. Any new build that is perceived as cheap should immediately raise a red flag.

As most of the underlying causes of cost are structural and not easy to fix quickly, and consequently with new build prices expected to continue to rise, the Portuguese off-plan market presents an excellent opportunity for investors, both institutional and retail (end buyers). Residential developers willing to spend the time can benefit from uplift in land values when successfully taking a project through planning, and end buyers can benefit from higher-than-average ROI and ROC because of capital appreciation during the build cycle. This is sensible foresight based on sustained demand for end product, rather than the speculative type of investment that characterised the years prior to the financial crash of 2008-9.

The need for urgent change across the sector

The current inflationary cycle means that developers are naturally more risk-averse, as are buyers. In a conversation with a large real estate consulting company recently, I was surprised to hear an experienced executive imply that he expected developers to underwrite the risk of a volatile market so as to offer greater buyer protection. He seemed to fail to recognise the substantial risks already undertaken by developers, many of which are difficult to quantify to an end buyer without laying bare the hugely prejudicial environment in which developers operate in Portugal. The opinion also seemed to contradict the so-called “appeal” of Portugal. If a country is indeed such an attractive investment destination, then surely a more balanced approach between developer and buyer risk must be adopted?

The combination of factors (or challenges) outlined above, make it “impossible to create new build projects at affordable prices for Portugal’s lower-middle and middle classes.” As we have been arguing for some time, eon way to inject more affordable product into the Portuguese market, is to approve, develop and sell more expensive product such that a percentage of larger schemes can also deliver an affordable housing component. Many ways exist to do this, such as waiving VAT (or applying a reduced rate of VAT) on the affordable housing component of any development; encouraging developer-buyer shared ownership schemes by waiving IMI and offering reduced VAT on new build; or reducing IMT on new builds that meet certain environmental or other criteria, they have a secondary positive effect on helping to meet other government targets.

It is even possible for the government to link VAT to inflation in an inversely proportional ratio, such that VAT is capped at the moment of project approval, at the prevailing rate, but then falls in line with inflation as and when costs are incurred: the logic is that if costs go up then the government will still earn its tax as per the original estimate – after all, with no value whatsoever being received by the developer in exchange for VAT payments, it seems at best grotesque that the government should benefit while consumers and economic agents suffer. A similar situation exists in respect of fuel duty in Portugal, that could benefit from a similar inflation-linked VAT solution.

Ultimately, if the government is unwilling to sacrifice its tax revenue, then it must offer developers, who are taking most of the risk, incentives for them to build new product.

What is evident is that development models will have to change and for this to occur and the roles of the protagonists will have to be remapped. Some examples of the possible trickle-down effect:

- The government needs to reduce the tax burden on real estate development, starting with VAT

- Councils need to start adding more value, beyond simply having the power to approve projects and ask for contributions. The council must deliver value directly to the local community, in exchange for the revenue it receives from developers. The percentage of monies received from developers that is used for general municipal expenses should be capped, and the remaining amount ring-fenced for direct investment into the local area of the development

- Developers need to promote and build products with a client type in mind. Generic products with little focus or differentiation will slowly disappear

- Banks need to undertake project-based risk analysis, not cross-collateralisation. If a project does not stand on its own merit, it should be turned down. This means banks recruiting industry experts who understand sectorial context and end buyer behaviour, rather than just bricks and mortar

- Buyers will need to change their mind set from the transactional to the context-driven aspirational. Over time, mini “joint ventures” or collaborations with developers should be allowed to develop, creating a shared objective approach

- End user finance should become increasingly flexible – we are already starting to see some solutions emerge in this area

- Real estate agencies should improve efficiency, with technology less of a differentiator due to universal access. As a result, real estate companies should be able to reduce their operating costs and consequently drop their levels of commission, contributing to lower transaction costs. They should be able to change their remuneration model, moving away from the commission-only model, to paying (at least in part) base remuneration, improving levels of quality in the sector, greater job security and ultimately more sales (and therefore inward investment). This will be reflected in a greater level of certainty which is of huge importance to alleviating pressure on social care, healthcare and associated sectors

- The Manpower Group’s May 2022 talent shortage survey demonstrates that Portugal is the world’s second most difficult recruitment market, with 85% of companies reporting difficulties in filling positions. Given that there is an abundance of qualified and indeed talented human resources in Portugal, it is clear that matching supply to demand is as much an issue in the human resource space as it is in the real estate sector.

In the Algarve, employers who continue to promote heavily seasonal employment will soon need to factor in the higher accommodation costs during the summer. In particular, those companies attracting non-resident, seasonal resources will soon be forced to contribute to the cost of housing during the competitive peak season, failing which the remuneration may simply not be sufficient to allow seasonal labour to move for the short summer. These shortages are already being experienced in other markets with similar seasonal characteristics to the Algarve.

Conversely, employees and workers need to adapt their thinking to a challenging reality for all protagonists in the real estate sector. Those who are or wish to be real estate agents should be ready to commit to sales targets and to be measured on results. The mentality of real estate sales as a quick and easy way to make money, or for someone to turn to when desperate for a ”filler” job, must disappear. Likewise, for companies looking to work with talented individuals, basic aspects such as paying out of pocket business expenses and the payment of competitive commissions must form the basis for attracting new talent.

Bibliography

Building costs hamper development – Essential Business (essential-business.pt)

Casas para comprar mais caras — idealista/news

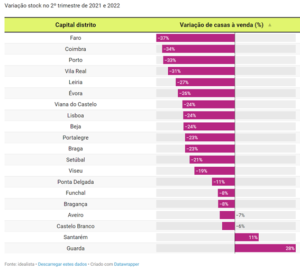

Oferta de casas à venda em Portugal desceu 25% num ano — idealista/news

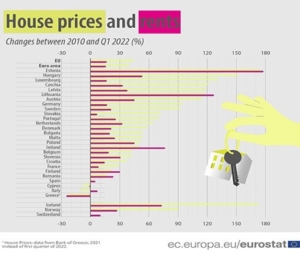

Lisbon house price increases higher than London – Essential Business (essential-business.pt)

Best Places for Digital Nomads? Lisbon, Miami Attract High Earning Executives – Bloomberg

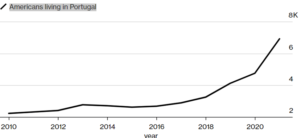

Americans Moving to Europe: Housing Prices and Strong Dollar Fuel Relocations – Bloomberg

Sale of homes to foreigners increases by more than 70% – Portugal Resident

Real Estate Speculation Has Made Lisbon One of the World’s Most Unlivable Cities (jacobin.com)

Home – CIA Landlord Insurance (cia-landlords.co.uk)

Portugal Will Be the First European Housing Bubble To Burst in 2023 – Value of Stocks

Preços das casas em Portugal cresceram 13,2% no segundo trimestre – Expresso