End of the Golden Visa

by Luis Teixeira da SilvaDÉJÀ VU…

THE END OF THE PORTUGUESE GOLDEN VISA…again?

It feels like ground hog day (or week) writing this…

In September of 2022, I penned a 3-part article that can be found here: The changing portuguese real estate market ( Part 3 ) – ALL ABOUT RETIREMENT OVERSEAS, analysing the factors that had contributed to the change in the real estate landscape. I also pointed out the need for structural change in Portugal’s development landscape to allow for more, and more affordable, product, to make its way to the market.

In November 2022, in an article that can be found here: The End of the Portuguese Golden Visa?, I referenced the Portuguese Prime Minister’s comments at the 2023 Web Summit. António Costa threw the cat among the pigeons by stating the Golden Visa program probably did not justify being retained.

The ensuing debate was emotive and every participant (including yours truly) had an opinion. As I have repeated many times, any statement by a senior Portuguese figure is usually a precursor to action. A proposal may undergo adjustment prior to implementation but it is usually an indication of intent.

Thus it is not surprising that a few months after Parliament voted against changes to the GV program, the same proposal is now back on the table. Except much broader and more severe.

Why is this happening now?

The Golden Visa program has become (rightly or wrongly) associated with the “ills” that have affected the real estate market. Three factors stand out:

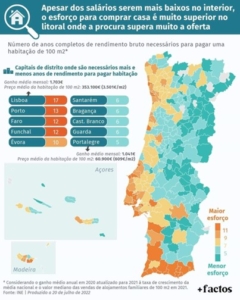

- Properties have become unaffordable to many local residents, in particular the younger generation

- With GV requiring such short stays, most properties have made their way to the short-term local lodging (AL) market that has displaced local residents and changed the characteristics of entire neighborhoods. As a result, the number of residential rentals has diminished

- The EU has been fighting against GV programs for some time, claiming they contribute to money laundering and possibly even to allowing the entry of terrorists into the Schengen area, and it might just be time to concede on this point

However, the government has not limited its proposals to the Golden Visa program.

A summary of the proposed changes

Much has been written about the proposed changes. For the moment, nothing is certain. The public consultation period runs for one month, to March 16th, 2023. Legislation could theoretically be implemented by decree. Even with resistance in parliament, the government has a majority, so can push changes through by itself.

The changes proposed include (the list is limited to those most likely to impact international investors and future residents):

- New real estate Golden Visas will no longer be allowed, of any type, anywhere

- Golden Visa renewals will come with conditions. Applicants and GV holders will be required to either make their property their primary residence or to ensure it is placed on the long-term rentals market. Those conditions are substantially different to the original conditions that were part of the GV program

- Incentives for transferring properties from short-term rental (local lodging or AL) to long-term rental (arrendamento)

- Compulsory rental of empty properties

- Rent control/caps

- The government will in some cases become the tenant with the right to sublease

- Penalties for planning delays

- Elimination of early repayment penalties on mortgage balances

Although a few positive measures have been proposed, they have been drowned out in the wave of uncertainty and by protests about the proposed changes. The general consensus from across almost all sectors of society, civil and professional, is that the government will never be able to implement all its proposals as some are not constitutional. I am neither a lawyer nor a constitutional expert, so I will simply point out the areas that appear to be most problematic:

- Appropriating vacant properties and forcing them onto the long-term lettings market

- Changing the terms under which original GV were granted, specifically in relation to the renewals. Most GV applicants chose the Portuguese GV program because of its low-stay requirements. Therefore, expecting that GV applicants make the property they have purchased (ignoring for the moment that some may not be suitable for permanent habitation) is unrealistic, and so the only option available under the proposed changes is to place the property on the long-term rental market

- Providing tax incentives for those moving from short to long-term lets, but excluding any rentals to immigrants (will an immigrant therefore be charged 25% more than a “local”, and indeed after how many months in the country, if ever, does an immigrant become “local” resident?)

- The government appointing itself as the tenant, with the right to sublet (a practice not common in Portugal) and with a government that is generally slow to pay

- Ongoing rent caps, contrary to the principle of an open market and freedom of use of private property

- Forcing Golden Visa investors to link renewals to a change in the use of their property to long-term rentals, in situations where the purchase is done in a project or condominium which is specifically zoned for tourism, for example, seems contradictory and difficult to implement given the legal classification of the property

The debate on social media, portals and discussion forums already includes threats by individuals or groups of individuals, to take the government to court if it proceeds with some of its proposals.

Practical steps that can be taken now

Among the uncertainty, most professionals and advisors are advising caution. That is fair, especially as a large part of the content of this article may change within weeks. However, there are some practical steps that appear sensible, low or relatively low risk, and that make the most of the changes. Some examples:

- Paying down mortgages: with increasing interest rates, anyone with capital in Portugal can reduce uncertainty and avoid early repayment fees, that have now been waived. For Portuguese citizens and residents who have some savings, do not have international investments, and are relying on paltry savings rates offered by local banks, the decision seems a “no-brainer” in most cases

- Switch on some utilities: to ensure that your property is not considered vacant, it seems as though the government will want to see evidence of some services being delivered within the previous 12 months

- Moving property into the long-term rental/letting market: generally, with the demand for long-term rental properties increasing due to residency visa programs such as the D7 (passive income or retirement) and D8 (digital nomad), and with the proposed special tax payable by AL owners, the proposed end of AL by 2030, and the tax exemption offered to those who move from AL to long-term rentals, there has never been a better time to start planning the move

- For existing GV investors, improving the chances of a Golden Visa renewal under new proposals: with the government progressively encouraging a move from short to long-term rentals, getting on a recognized long term lettings program is essential. A lot of people are talking about potential legal challenges if the government ploughs ahead with some of its proposals. But legal action can be time-consuming. Protecting income streams and asset value, together with guaranteeing residency, should be accomplished first.

Ignoring the history of policy-making in Portugal is risky. When a senior political figure makes an announcement or a prediction of this type, change is usually inevitable. It does not mean that the changes will be implemented exactly in the manner of the original announcement, but it is an early warning that changes will happen.

Most of the proposals are likely to be implemented, to a greater or lesser degree.

We observe government already providing some solutions to the challenges it has created with its own proposal. An example is the proposed 7-year tax exemption (until 2030) on income for owners who move from AL or local lodging, to arrendamento or long-term lets.

Based on past experience of other programs such as the NHR regime, that lasted 10 years at 0% tax before being changed, it is likely that within the 7 years the zero-tax position will erode. Acting swiftly to ensure a degree of certainty in a continuously changing fiscal landscape, is crucial. Also, expect many exceptions to the rule.

For new applicants, what is the alternative to the Golden Visa?

Portugal needs to attract more permanent residents who contribute directly to the local economy by spending on local services, and who pay their tax locally (by becoming tax residents).

Portugal has a residency visa known as the D7, for applicants with a passive income. Recently, digital nomads may apply for residency via the D8 visa.

The D7 and D8 visas are more flexible than the Golden Visa in that applicants can rent or buy a property. There are no geographic restrictions or minimum value. Conversely, applicants must live in the country for, on average, more than half a year, each year. The GV only requires an average of 7 days per annum.

Disclaimer: expect some of this to be outdated by the time it is published, and when seeking advice from duly qualified professionals on the changes, don’t rely on one single “expert” – consult or poll several!

The changing portuguese real estate market ( Part 3 )

by Luis Teixeira da SilvaEmerging sources of clients, supply versus demand imbalances and much more.

The chasm between cost and access to accommodation by local people, and the cost of delivering new inventory

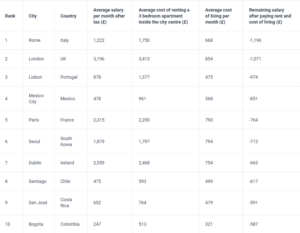

In a report by CIA Landlord Insurance in the UK, published in March 2022, Lisbon is ranked as the third least viable city in the world in which to live, if you are renting. This is due to the discrepancy between disposable income for local people, and the cost of housing.

The Portuguese government has no consistent policy to deliver new housing, much less affordable housing, on any scale. Delivery of Build to Rent, previously also known as PRS (private rental sector), inventory, is practically impossible due to, among other factors, the tax burden. At least 35% of the total cost of any new construction is tax (of which the most significant are: VAT of 23% on cost of construction; 1.23% VAT on sales agency commission; around 5-6% IMT; notary costs; fees and contributions, including compensatory payments, by developers to municipalities). This excludes the cost of bureaucracy and delay which are borne by investors as a reduction in returns, and may be transferred to end buyers via price increases.

Why will new build continue to increase in value (and price)?

In addition to the benefits of newer, more efficient, more environmentally considerate technologies and materials, all of which come at a price, there is also the cost related to the process of developing a new project. As comment by a senior executive at a leading real estate consulting firm in Portugal: challenges include “high property taxes, VAT, and the sheer time it takes to get planning permission from city halls and local councils. This, in turn, makes it impossible for developers that normally plan ahead by up to 10 years, to keep to their original costings and budgets, thereby scaring off investors in this particular residential housing segment.”

The Portuguese Property Survey (PIPS), produced by the magazine Confidencial Imobiliário and the APPII, in May of 2022, reported that there had been an “increase in construction costs of 18% over the past year”. This cost will have to be passed on, in part or in full, to the end buyer.

A combination of existing lack of product, low levels of new build, an increase in labour and materials costs, high tax and slow planning cycles, mean that it is impossible to deliver affordable new build. Any new build that is perceived as cheap should immediately raise a red flag.

As most of the underlying causes of cost are structural and not easy to fix quickly, and consequently with new build prices expected to continue to rise, the Portuguese off-plan market presents an excellent opportunity for investors, both institutional and retail (end buyers). Residential developers willing to spend the time can benefit from uplift in land values when successfully taking a project through planning, and end buyers can benefit from higher-than-average ROI and ROC because of capital appreciation during the build cycle. This is sensible foresight based on sustained demand for end product, rather than the speculative type of investment that characterised the years prior to the financial crash of 2008-9.

The need for urgent change across the sector

The current inflationary cycle means that developers are naturally more risk-averse, as are buyers. In a conversation with a large real estate consulting company recently, I was surprised to hear an experienced executive imply that he expected developers to underwrite the risk of a volatile market so as to offer greater buyer protection. He seemed to fail to recognise the substantial risks already undertaken by developers, many of which are difficult to quantify to an end buyer without laying bare the hugely prejudicial environment in which developers operate in Portugal. The opinion also seemed to contradict the so-called “appeal” of Portugal. If a country is indeed such an attractive investment destination, then surely a more balanced approach between developer and buyer risk must be adopted?

The combination of factors (or challenges) outlined above, make it “impossible to create new build projects at affordable prices for Portugal’s lower-middle and middle classes.” As we have been arguing for some time, eon way to inject more affordable product into the Portuguese market, is to approve, develop and sell more expensive product such that a percentage of larger schemes can also deliver an affordable housing component. Many ways exist to do this, such as waiving VAT (or applying a reduced rate of VAT) on the affordable housing component of any development; encouraging developer-buyer shared ownership schemes by waiving IMI and offering reduced VAT on new build; or reducing IMT on new builds that meet certain environmental or other criteria, they have a secondary positive effect on helping to meet other government targets.

It is even possible for the government to link VAT to inflation in an inversely proportional ratio, such that VAT is capped at the moment of project approval, at the prevailing rate, but then falls in line with inflation as and when costs are incurred: the logic is that if costs go up then the government will still earn its tax as per the original estimate – after all, with no value whatsoever being received by the developer in exchange for VAT payments, it seems at best grotesque that the government should benefit while consumers and economic agents suffer. A similar situation exists in respect of fuel duty in Portugal, that could benefit from a similar inflation-linked VAT solution.

Ultimately, if the government is unwilling to sacrifice its tax revenue, then it must offer developers, who are taking most of the risk, incentives for them to build new product.

What is evident is that development models will have to change and for this to occur and the roles of the protagonists will have to be remapped. Some examples of the possible trickle-down effect:

- The government needs to reduce the tax burden on real estate development, starting with VAT

- Councils need to start adding more value, beyond simply having the power to approve projects and ask for contributions. The council must deliver value directly to the local community, in exchange for the revenue it receives from developers. The percentage of monies received from developers that is used for general municipal expenses should be capped, and the remaining amount ring-fenced for direct investment into the local area of the development

- Developers need to promote and build products with a client type in mind. Generic products with little focus or differentiation will slowly disappear

- Banks need to undertake project-based risk analysis, not cross-collateralisation. If a project does not stand on its own merit, it should be turned down. This means banks recruiting industry experts who understand sectorial context and end buyer behaviour, rather than just bricks and mortar

- Buyers will need to change their mind set from the transactional to the context-driven aspirational. Over time, mini “joint ventures” or collaborations with developers should be allowed to develop, creating a shared objective approach

- End user finance should become increasingly flexible – we are already starting to see some solutions emerge in this area

- Real estate agencies should improve efficiency, with technology less of a differentiator due to universal access. As a result, real estate companies should be able to reduce their operating costs and consequently drop their levels of commission, contributing to lower transaction costs. They should be able to change their remuneration model, moving away from the commission-only model, to paying (at least in part) base remuneration, improving levels of quality in the sector, greater job security and ultimately more sales (and therefore inward investment). This will be reflected in a greater level of certainty which is of huge importance to alleviating pressure on social care, healthcare and associated sectors

- The Manpower Group’s May 2022 talent shortage survey demonstrates that Portugal is the world’s second most difficult recruitment market, with 85% of companies reporting difficulties in filling positions. Given that there is an abundance of qualified and indeed talented human resources in Portugal, it is clear that matching supply to demand is as much an issue in the human resource space as it is in the real estate sector.

In the Algarve, employers who continue to promote heavily seasonal employment will soon need to factor in the higher accommodation costs during the summer. In particular, those companies attracting non-resident, seasonal resources will soon be forced to contribute to the cost of housing during the competitive peak season, failing which the remuneration may simply not be sufficient to allow seasonal labour to move for the short summer. These shortages are already being experienced in other markets with similar seasonal characteristics to the Algarve.

Conversely, employees and workers need to adapt their thinking to a challenging reality for all protagonists in the real estate sector. Those who are or wish to be real estate agents should be ready to commit to sales targets and to be measured on results. The mentality of real estate sales as a quick and easy way to make money, or for someone to turn to when desperate for a ”filler” job, must disappear. Likewise, for companies looking to work with talented individuals, basic aspects such as paying out of pocket business expenses and the payment of competitive commissions must form the basis for attracting new talent.

Bibliography

Building costs hamper development – Essential Business (essential-business.pt)

Casas para comprar mais caras — idealista/news

Oferta de casas à venda em Portugal desceu 25% num ano — idealista/news

Lisbon house price increases higher than London – Essential Business (essential-business.pt)

Best Places for Digital Nomads? Lisbon, Miami Attract High Earning Executives – Bloomberg

Americans Moving to Europe: Housing Prices and Strong Dollar Fuel Relocations – Bloomberg

Sale of homes to foreigners increases by more than 70% – Portugal Resident

Real Estate Speculation Has Made Lisbon One of the World’s Most Unlivable Cities (jacobin.com)

Home – CIA Landlord Insurance (cia-landlords.co.uk)

Portugal Will Be the First European Housing Bubble To Burst in 2023 – Value of Stocks

Preços das casas em Portugal cresceram 13,2% no segundo trimestre – Expresso

The changing portuguese real estate market ( Part 2 )

by Luis Teixeira da Silva

Emerging sources of clients, supply versus demand imbalances and much more.

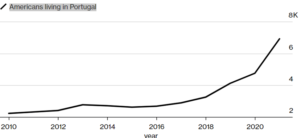

The increase in the presence and importance of the North American market

The Portuguese borders agency, SEF, has reported a large growth in US citizens choosing Portugal as their residence. While admittedly from a tiny base, the growth of this market underscores the increase in relative wealth of the average person seeking Portugal as their new home. Even those Americans who only receive Social Security payments, are receiving a pension substantially above the Portuguese average. The Canadian market is equally important, because a number of Canadians of Portuguese descent are seeking a return to their roots, and although the Canadian dollar does not represent the same purchasing power as the US dollar, incomes are substantially above those in Portugal. The USD and CAD have appreciated 20% and 14%, respectively, over the last year.

As Bloomberg reports, “retirees and the wealthy have traditionally been the prime buyers of real estate in Europe. But relatively cheap housing — particularly in smaller cities and towns — and the rise of remote work have made the continent alluring to a wider range of people, including those who are younger and find themselves priced out of the housing market at home. Growing crime rates in some US cities and political divisions have also led Americans to look across the pond for a quieter lifestyle, buoyed by a euro that just dropped to parity with the US dollar for the first time in more than 20 years.”

The effect of the supply and demand imbalance

Essential Business, in an article in July 2022, cites that the “residential segment, which today is highly dependent on real estate development (new build) is Portugal’s weak point at present, with the number of units absorbed by pre-existing products (second-hand) in the market far more expressive when compared to new products, owing to an absence of sufficient new stock in the market. The new build market has flatlined since 2011.”

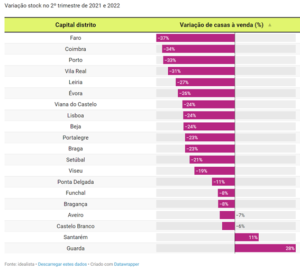

In an article, also in July 2022, published by the idealista portal, it is reported that there has been a 25% decrease in available inventory over the preceding 12 months. This problem is most acute in the Algarve problems, where supply has diminished 37% year on year.

Although rents have also gone up in value, they have not done so by the same margin as sales prices. For this reason, and despite the perception that rents have become expensive relative to 2010, they are still more competitively priced in 2022 than properties for sale.

The changing portuguese real estate market

by Luis Teixeira da SilvaEMERGING SOURCES OF CLIENTS, SUPPLY VERSUS DEMAND IMBALANCES AND MUCH MORE

The growing popularity of Portugal

Some would say that it is ironic that the international market and investment has done what Portugal and the Portuguese could not find the courage to do themselves, namely value their patrimony fairly. With decades of cheap real estate culminating in the financial crash of 2008-2009, the Portuguese were extremely hesitant in making investments in the real estate market of their own country. Accustomed to seeing the dramatic effects of global crises reflected in extremely difficult local market conditions, the majority of the population remained sceptical when the first signs of a recovery when noted around 2014. As international investment grew, bolstered by programmes such as the Golden visa and the non-habitual resident programme, real estate prices rapidly increased, and by the time most Portuguese had gathered enough courage to act, most had been priced out of the market.

The effect of Portugal’s popularity on real estate prices

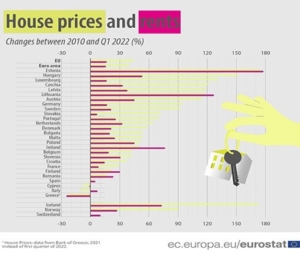

According to a report compiled by Idealista, Portugal prices have increased 70% in 10 years (2012-22), much higher than the European average of 45%.

The source of growth

As an example, Savills’ World Cities Prime Residential Index, which includes 30 cities around the world, ranked Lisbon as the 7th city where prices had grown the fastest in the first half of 2022, at 3.7%, versus an index average of 2.4%.

The role of foreign direct investment (FDI) on Portugal’s real estate market

Although the cyclical nature of real estate markets (and indeed economies) is acknowledged, this decade-plus cycle of sustained growth in Portugal, largely independently of a pandemic, a war and of somewhat depressed internal demand, seems to indicate something different. Given that Portugal’s internal market is largely unable to sustain such growth, due to still-low salary levels (and consequently limited disposable income) and small size, it is the international market and foreign investment that has been the main driver of this trend.

Backing up this opinion is a quote in Essential Business in July 2022 that confirms that “in 2012, as Portugal was still in the depths of the Great Recession, 46% of investment in Portugal came from overseas, today that figure has shot up to 85%…the overall investment in real estate development in Portugal, in 2016, was €200 million of which less than 50% came from overseas investors. That figure has shot up to an incredible €375 million in 2021, a year in which the world was still affected by the pandemic.”

The National Institute of statistics reports that investment from EU countries increased by 72.3% in Q1 2022, while foreigners buying from non-EU countries increased by 79.1%. In total, foreigners acquired 2556 properties in the first quarter of 2022.

At a granular level, what we observe is the increase in wealthier investors and buyers, meaning that competition for product is greater, prices tend to increase and demand for the upper and luxury segments of the market including new build, remains fairly buoyant.

One of the reasons for this is the trend described in the Henley global citizens report 2022 which shows that Portugal ranks in the top 10 countries expected to receive new millionaires during this year, approximately 1300. New World Wealth shows that Portugal 4, for example, has been one of the most popular destinations for the flow of HNW capital, capturing some of the 4500 high net worth South Africans that have left the country in the last decade.

Bloomberg UK also quotes a Savills report stating that Lisbon, together with Miami and Dubai, is ranked as the top city for high earning remote based talent, specifically senior staff.

Changes to the Golden Visa and Non Habitual resident programmes

by Luis Teixeira da SilvaTHE SUCCESS OF THE GOLDEN VISA PROGRAMME

Golden Visa investments represent more than €4 billion into the Portuguese economy. This influx of capital has a direct correlation to the massive inflation in house prices in areas such as Lisbon and Porto, where the majority of the GV investment is concentrated.

The Golden Visa program in Portugal has been a success when measured by total investment, diversification of investor base and origin, and the successful rehabilitation of abandoned urban areas.

THE NON-HABITUAL RESIDENT REGIME

Dovetailing with the GV program, the Non-Habitual Residence program, which is explained here, has reinforced the upward price movement. It is much more focused on attracting permanent residents who contribute to the local economy.

Residence under the NHR does not require the purchase of a property, with a rental contract being sufficient. Therefore demand for long-term rentals, and subsequently prices, has increased. Property owners were attracted by the allure of a constantly-improving tourism market and the arrival of wealthier, expatriate tenants. They registered rental properties with tax authorities at a faster rate than even that anticipated by the government. Long-term rentals, which attract higher tax and stamp duty, are much in demand by foreign applicants of the NHR program.

WHY REAL ESTATE IS SUCH AN IMPORTANT SOURCE OF REVENUE FOR THE GOVERNMENT

Real estate represents a major source of growth for the Portuguese economy. It has a knock-on effect on sectors such as tourism and construction, both labour-intensive. The country has achieved a rather unique result:

- it attracted investment, much of which at an average value well above previous transactions. Programs such as the Golden Visa had an inflationary effect on prices;

- the government “encouraged” (read, threatened) all owners of short-term rental properties to register them. Owners were encouraged to do so via initially low rental taxes. Accounting firms were also eager to generate additional revenue from this service; and

- it attracted expatriate residents eager to benefit from an exemption of personal income tax on foreign-earned income. This generated a major source of tenants for the newly available inventory, as well as buyers of real estate in their own right.

The government’s tax base (pool of taxpayers from whom taxes could be generated) grew significantly in less than five years. With Portugal suffering for many years post-2008 from a desperate need to generate inward investment to balance its books, these programmes achieved two important goals: an immediate injection of foreign investment into the local economy; and the widening of the tax base such that the sources of tax grew while the predictability of future revenues improved.

The Portuguese government has for years used real estate as a way of generating additional tax revenue. It is an easy source of income, and one which cannot easily (when compared to other asset classes) be sold. Stocks and shares, for example, which carry substantial exemptions on resale, can be quickly sold.

For those who monitor the market closely, changes to real estate related legislation have been predicted for some time.

CHANGES TO THE GOLDEN VISA AND NHR PROGRAMMES

Rumours about the possible revision to the zero-tax status of the NHR program started in 2018. Pressure on the government, which did not have a working majority, strengthened in 2019. Expectations were that any changes would only be implemented in 2021. But the government surprisingly introduced a proposal for a 10% tax, with a minimum of €7,500, for implementation in 2020. Although not expected to apply retrospectively, it will affect any new NHR applications submitted from around March.

That same pressure on the government also led to the sudden proposal for the abolishment of the Golden Visa in the greater Lisbon and Porto areas. This pressure also stemmed from years of complaints about overtourism, lack of access to housing for local residents, and the questionable value of the Golden Visa program beyond profits for real estate developers. The proposal garnered cross-party support. The message is that any legislative changes will not be retrospective but will apply to any applications from January 1, 2021.

Given these proposed changes, many people have asked us for our opinion.

WHAT WE THINK…

The first and most important thing we recommend is to allow time for the process to take its course. We recommend making decisions based on facts once Parliament has voted.

If you are considering a Golden Visa in Lisbon and Porto, either act quickly or put your application on hold. The threat of a potential change will always linger over these two large, residential markets. It is unclear what, if any, impact this may have on property prices, given the diversification of the market in recent years. But the Golden Visa has had a significant inflationary effect on property prices in these locations. Chinese buyers have been major contributors to this phenomenon.

Those who are seeking a Golden Visa investment without particular affinity for Lisbon or Porto, should immediately start to seek alternative options. Investors should classify themselves into one of two groups: those seeking the cheapest available real estate Golden Visa, might consider going north or inland; and those seeking an investment return should head south. Anyone who actually intends to spend more than the minimum requite time in the country, should overlay their personal preference of the regions of Portugal, on one of the groupings above.

Investors should be aware that agents, developers and sellers in regions outside Lisbon and Porto will naturally talk up their regions. Buyers should analyse fundamentals and ask for evidence. But they should not apply stricter criteria than they would have applied to Lisbon or Porto.

NOW IS THE TIME TO ACT…

Finally, we encourage investors to act quickly when you have the facts. While Portugal and the Portuguese can be quite dynamic and inventive, the country does not offer fiscal stability. Any decision should minimise the risk of future changes. Avoid overpriced purchases, buy properties with proven rental revenue history, buy in locations with resale values that have increased. Investors should also consider alternative approaches such as a small portfolio versus a single property. And for the more adventurous, development opportunities are still available in excellent locations.

The message here is change. Expect it, and do not be surprised when it happens. And more importantly, don’t be surprised when the change goes against you. If you are a pragmatist and understand that tax efficiency is the “icing on the cake” then Portugal continues to represent some wonderful opportunities, both in terms of investment and lifestyle.

* Disclaimer: a number of statements in this article refer to events which may happen in the future. The results may be exactly the same as, or completely different to, what is predicted. One of the objectives of this information is to make people aware of the possible changes. We encourage those interested to seek advice from duly qualified sources (of which Facebook is not one).

Planning for the Golden Years

by Luis Teixeira da SilvaPlanning for the Golden Years:

the modern-day “Gold” rush in the California of Europe

Anyone who is nearing or at retirement age wants to protect his or her hard-earned pension. Many want to do this in a safe country with a warm climate, friendly people and a great lifestyle.

Equally, many people from outside Europe aspire to have free access to, or live on, the “Old Continent”. As do those who have a highly mobile lifestyle but want a base in a low-tax environment.

Now one country has made it easy to do all the above.

Racking up the accolades

World’s and Europe’s Leading Destination 2017. 3rd safest country in the world. 7th friendliest people. 12th best healthcare. World’s best golfing destination. Europe’s best beach destination. Lowest cost of living in Western Europe. Lowest property purchase taxes of any Southern European country. Near the top of the rankings in the Quality of Nationality Index meaning its passports makes it among the best options for visa-free travel.

Portugal. The ugly duckling turned swan.

A few years ago, no one wanted to touch it. The IMF was bailing it out. The English were calling it names – one of the PIGS. Even the Prime Minister publicly encouraged its youngsters to emigrate (interestingly, many are now returning, with half a decade of additional international expertise to offer their land of birth).

Now, fastest growing European economy in Q1 2017. Eight years of record-beating tourism numbers. New host of the Web Summit, the world’s premier IT and emerging technology investment conference. Land of the birth of the President of the European Commission, President of the Eurogroup, and the UN Secretary General. 10th largest exclusive economic zone in the world, 97% of which is sea. A country punching above its weight.

Whimsical waves: a replica caravel sails over tranquil waters along the pristine Algarve coastline near Benagil And home to Europe’s most popular Golden Visa program.

The most golden of Golden Visas

Why, you may ask, if Spain has several times more visitors than Portugal and there are more Spanish-speaking people in the world, and if Greece has a Golden Visa investment level half that of Portugal, has this small country on the Western edge of Europe become the most popular destination for those looking for residence in Europe via investment?

The reasons for the approximately €4 billion invested in this program to date are varied and many:

⦁ In addition to the Golden Visa itself, the Portuguese nationality and passport, are highly sought-after. With visa-free travel to 157 countries, a Portuguese passport is among the world’s top 5 for hassle-free travel;

⦁ Portugal has 79 double tax treaties signed with other nations. This is relevant because it underpins the country’s highly successful NHR (Non Habitual Resident) program, which broadly allows eligible applicants to pay no tax on any foreign-earned income (including pensions);

⦁ Portugal has no wealth taxes (except for a newly implemented real estate tax for individual property ownership greater than €600K (based on fiscal value which is generally lower than market value or purchase price) or joint ownership above €1.2 million)

⦁ There is no inheritance tax and owning property in own name is very efficient

⦁ Property is sold freehold, with rare exceptions. The land registry is among the most reliable in the world. Property is fully documented and protected

⦁ Permanent right to reside after 5 years (with no requirement to reside, unlike Spain and Greece)

⦁ Easy family aggregation providing the family with the full right to reside, work and study

⦁ Very few nationalities are “excluded”: it is the analysis of the person’s individual circumstances and history, together with the source of funds, which are relevant to any application.

The Portuguese Residency by Investment (better known as the Golden Visa) was launched by the Portuguese government in October 2012, but only saw its first approved candidates in the second half of 2013. It is a fast track method for foreign investors from non-EU countries to obtain an authorisation to reside in Portugal and can be summarized as follows:

⦁ Permanence requirements include 1 week in the first year and two weeks in every subsequent two-year period. Applicants are free to travel within the Schengen vis travel area

⦁ First entry must be via a valid Schengen visa or visa waiver program

⦁ Applicants have the right to work if they wish

⦁ Citizenship and a Portuguese passport can be obtained after 5 years of residency. A basic Portuguese language test must be passed

⦁ Applicants must not have a criminal record, be banned from entering the country or be flagged in the Schengen system

⦁ Initial application fees are around €5,200 per family member with two-yearly renewals at 50% of that value. Legal fees can be just as high but many smaller solicitor firms and other expert partners are able to deliver this service for a much lower cost – in some cases absorbing it into their conveyancing fee. Find a local partner who can make suitable introductions to a range of experts.

The most popular route to investment is via the purchase of real estate, under the following rules:

⦁ Standard investment is €500,000, sourced from funds brought from outside Portugal without recourse to credit or debt financing. Any amount above the GV threshold may be financed

⦁ Any type of real estate qualifies. Shared or co-ownership applies as long as the minimum threshold is met per investor

⦁ A reduced level of €350,000 for approved rehabilitation projects in properties of at least 30 years. The criteria for qualification are strict and for most investors this is not a practical solution

⦁ Either of the above levels maybe reduced further by 20% if located in a low population density area. An excellent opportunity exists in key municipalities in the country, one of which is discussed in this article

⦁ The Golden Visa investment can be sold after the 5 year period

Setting out your stall and claiming your stake

Just as those who trekked across the US to find fortunes in California depended on staking their claim to the right plot of land, so too selecting the right region for investment is crucial in Portugal. Factors such as ease of resale, likelihood of appreciation, and rental yields, must be taken into account before deciding where to invest. Crucially, if the property is to also become a family holiday home or a permanent place for work or enjoy your golden years, then a match to holiday requirements for the family, to airports with good international connections or to a place which offer a balanced lifestyle and cost, must be factored.

Experience has shown that most, if not all, who visit it will fall in love with something: those from Canada and the US love the authenticity combined with first-world infrastructure; those from Latin America see the gateway to Europe as an opportunity to have a foot in Europe while retaining traces of home, including a similar language; those from Asia are impressed by the family-friendly environment and the openness to multiple cultures.

But beware Portugal’s beguiling charms: not every region is a match for every investor. Tourism is one of Portugal’s largest industries and exports and there is a reason why the Algarve and greater Lisbon are, respectively, the two largest tourist destinations in the country.

Sunshine is a main factor. And the further north one goes, the less you see it, especially in the rainy winters. So even if you are enamored with the Douro valley, spanned by myriad bridges and traversed by port-wine bearing barges, consider whether you will accept gray skies in the winter and less intercontinental airline connections.

People. Another major driver. While you may fall in love with an inland area such as the beautiful Alentejo, with its world heritage sites and golden fields of barley, it is an area with small villages and with low population density. Great for buying cheaper properties but not great to obtain a yield. Greater travel distances. Less English spoken. Very quiet in the winter.

Planning your approach

Keep your options as open as possible. If you are looking for a Golden Visa and residence, then stay as close to the purchase limit as possible. That way, you ensure that you are able to resell or, if you need to keep the property, you will stand a better chance of not being out of pocket.

Look for reduced investment Golden Visas, avoiding areas which have seen huge price increases. Look for regions which might still be undervalued. And most importantly, if you want to generate revenue, look at where the source of demand is.

David vs. Goliath?

Lisbon. Nation’s capital and center of government and power. A fantastic weekend destination, with plenty of historical monuments, culture, gastronomic options, cheap travel and excellent beaches not far away. Great for workers, especially mobile ones. Pretty good for retirees if you don’t mind the hills, are happy to take safe and cheap public transport or hop in an equally inexpensive cab. Best range of healthcare options.

One problem: a booming real estate market that is starting to look very much like a bubble. Think Golden Visa. Add exploding Chinese middle market. Overlay with a €500,000 Golden Visa limit. Net result: any owner of a 2-bedroom apartment in the city thinks they can ask for €500,000 from a foreign buyer. Local buyers don’t even bother trying to buy those types of properties anymore.

The Algarve. One of the world’s top tourist destinations. Portugal’s number 1 spot for both national and foreign visitors. Great for sports lovers: walkers, ramblers, surfers, golfers. Excellent for fish and sea food lovers, but then again, so is Lisbon. OK for culture. Good set of public and private healthcare options.

Two advantages: much better bang for your buck in real estate terms. And better weather.

Algarve: Best Place in the World to Retire

The tourism crown jewels are the country’s southernmost province, the Algarve, with beaches of golden sands, cliffs of golden light and sea of azure that many mistakenly think is on the Mediterranean. Even the cool Atlantic seems to be warmer in the Algarve, voted seven years in a row “Best Place in the World to Retire” by the Overseas Retirement Index.

The Algarve has mostly been overlooked until now as a destination for the Golden Visa, primarily for the following reasons:

- Those nationalities showing most interest to date, namely Chinese and Brazilian, who have jointly invested almost €4 billion, want urban locations such as Lisbon;

- Many who like a more suburban feel, such as South Africans, Americans, Turkish, Russian and the remaining Brazilians, have been shown Cascais by local agents. Only some investors have managed to remain at the €500,000 level due to the upmarket locations and property which are being shown. Investors are almost inevitable being upsold into spending more than the required amount;

- With Lisbon prices climbing to historical highs and buyers priced out of the market, the Golden Visa wave has broken on the shores of Portugal’s northern city, Porto, which has seen its real estate prices also rise dramatically;

- The first wave of GV buyers was looking for new or recently refurbished properties. As the country has seen new construction at a standstill since the 2008-9 crisis, there has simply been insufficient inventory available. The Algarve reflects this situation, with new-build properties representing a price per square metre at the very top end of the national average.

However, the region offers a very interesting variety of Golden Visa options and much more variety, in our opinion, than any other highly desirable location in the country. With the Algarve already the country’s top tourist destination and the region’s economy relying heavily on this sector, Golden Visa product should not affect the local residential market nor disproportionately inflate prices, as has been the case in the Lisbon and Oporto markets, because its appeal will continue to be to the foreign market. In fact, the Algarve’s Golden Visa product should increasingly act as a catalyst for the injection of more investment into the region’s tourism sector, by diversifying the “simple” €500K which has typified the region to date.

Research and knowledge: your pick and shovel

If the residence visa is your main aim, stick to your objective. Numbers first. Many beautiful villas can stretch your budget by hundreds of thousands of Euros. And there is always a more beautiful and more perfect property to be found.

Choose a partner who will be aligned with your objectives and budget. Consider entering into a buyer agreement with someone who can work for you rather than earning their fee from the seller.

If you are thinking of settling, ensure you take a Discovery Tour. Get an experienced company to show you the areas and examples of real estate within each, before taking the plunge. Rent before you buy if you are not sure. Ensure that you have found a place where you can live in the quieter winters and the busier summers.

Be aware of the regional subtleties:

⦁ Higher yields are more difficult to achieve in the greater Lisbon area because prices are higher (even though rentals are also higher)

Properties in the Algarve come furnished, increasingly to a high standard. Lisbon properties are unfurnished unless specifically set up for short-term lets

⦁ Lisbon is a year-round destination even though the winter is slower than the summer. Either weekly lets or annual lets are the preferred model. The Algarve still experiences great variations between summer and winter. But as properties are furnished, weekly summer rentals can be combined with monthly winter lets for maximum return.

his is realistically only possible in the Algarve.

Eldorado: combining location with value for optimal Golden Visa value

With Lisbon overpriced and good deals increasingly difficult to find, the Algarve should at least be on investors’ short-list. The key should be to look for good value for money opportunities. The Algarve is a narrow strip of land where most of the development is concentrated near the coastline. The main factors for optimal value in the region are proximity to the coast (15 minutes maximum, less is better), distance to golf course (again, near the coast and you are guaranteed to be within 15 minutes of one) and being south of the region’s A22 highway.

When overlaying this with quality real estate or modern or contemporary construction, many of the region’s properties are priced well above €500,000. Well known for the extremely exclusive (and equally pricey) real estate is the Golden triangle which encompasses Quinta do Lago and Vale do Lobo, where two bedroom apartments are easily between €650,000 and €1 million, and a 3 bedroom villa worth millions of Euros. Upmarket areas such as Vilamoura, Carvoeiro and the Lagos municipality are less expensive but all of them still require a minimum €500,000 Golden Visa investment.

Travel to the province’s western-most municipality, most famous for Henry the Navigator’s maritime school in Sagres and the country’s second most popular surfing location, and you will find an area of stunning natural beauty, of imposing cliffs, mile-long beaches and one of the country’s largest natural parks along the Costa Vicentina. Because its natural landscape is mostly untouched by large-scale development, the number of residents is still low.

Therein lies the opportunity for Golden visa applicants: in low- density population areas the investment threshold is reduced by 20%, to €400,000. In this region, some stunning Golden visa opportunities exist. Quality contemporary properties; resorts (including golf resorts) with multiple services; and amenities and well-located properties perched atop coastal villages, offer excellent opportunities in a region which combines natural beauty and proximity to wonderful beaches, with the benefit of the Algarve’s tourism growth.

The municipality continues to benefit from the Algarve’s eight years of record-beating tourism as well as the demand by permanent residents, many of whom retirees, for sunshine, great lifestyle and low taxes / cost of living.

Examples of the great Golden Visa deals on offer include a fully furnished executive 3 bedroom golf course villa, with shared pool, expansive golf views and access to a wide range of amenities including golf, on-site restaurants, spa, and tennis, for under €415,000 and which comes with a fixed guaranteed income in the first year. This property, well managed, can easily generate a gross yield of 6-7%. A smaller 2-bedroom property on the same resort with two years of guaranteed 5% revenue is for sale at €400,000.

Just down the road, luxury 4 and 5 bedroom villas on a leading eco-resort can be bought for between €400,000 and €500,000. It is also possible to “package” up several plots, complete with full planning, which can be held for later resale or used to build single-family villas or townhouses.

Finding residence, lifestyle and solid investment is very much possible if you know where to look! Enjoy your golden years the best and smartest way!

Annuity Failing You? FIXED-INCOME Care Suites

by Luis Teixeira da SilvaIS YOUR ANNUITY FAILING YOU?

CONSIDER INVESTING IN FIXED-INCOME CARE SUITES

It was the day after the referendum of June 23rd 2016 that I realised that my British Pounds would not buy me as much as the day before. In fact, about 20% less, although that has now “recovered” to 15%!

Suddenly, travelling to Europe, living my retirement in Europe and even making my hard-earned British pension stretch had just become 15% more difficult. And much less predictable than before. Worse, since the referendum, inflation in the UK has risen to around 3% which means that the pitiful returns the banks are giving us on our own money, typically less than 1%, are eroding our capital. Each year money in the bank is worth less.

There is a simple distinction between working life and retirement: in the former, we work for money, in the latter money must work for us so that we can enjoy our later years. Many retirees have been let down by underperforming annuities, a depreciating currency, and most recently higher inflation. All this means that the quality of life in later years is at the risk of getting worse. It is therefore crucial that everyone think seriously about how to protect and grow their retirement pot.

Expat retirees with a new life in Southern Europe still have family or financial links to the UK. Not everyone is comfortable severing all links with the UK. With Brexit looming, a majority of those retiring abroad are wondering how to ensure they retain rights and protect income in both the UK and EU.

Dealing first with the question of right of residence in the EU: even if no deal is reached between the UK and the EU, from a procedural point of view, a “cliff-edge” Brexit will place the UK in the same category as those applying to reside in Europe, whose origin is outside the EU. Such applicants need a visa to enter the area and to remain as residents. In countries such as Spain and Portugal a Golden Visa category exists which allow people to invest in exchange for residence.

While it may be difficult for expatriate residents to apply to be “new residents” in a country where they have lived for some time, it is very feasible for expats in Spain to seek, for example, residence in Portugal, with those who are eligible also applying for tax-free status, a way to protect and maximise pension payments. One of the criteria is not to have been resident in Portugal during the last 5 years.

Expat retirees will also want to make sure that their assets, savings and income in the UK are maximised. However, in later years, our appetite for risk (understandably) decreases. With this in mind, and with many financial groups admitting that annuities do not deliver viable long-term solutions, the search is on for alternatives.

One sector of the market presents interesting opportunities for capital protection and steady capital growth. A sector which most expats in Southern Europe understand: social care.

Currently care in the UK is privately funded until one’s estate is worth just £23,000 (this is under discussion). Care home places are limited, means-tested and include value of your home. Retirees often need to sell their home to fund care. Most residents in care homes have a life expectancy of a further 10-15 years, creating long waiting lists. Care home occupancy is currently running at almost 90% and fees average £700 per week.

In the UK, 8 million people will be aged 80 or more, and 1 in 4 people will be 65 or more by 2050, double current levels. The failure of small care homes due to a number of factors including rising costs (which will be exacerbated when the UK leaves the EU), create knock-on effects leading to problems such as “bed blocking”. There is huge pressure on existing care homes and an urgency to create new care home places.

As a result, a number of companies have taken on the refurbishment of old or abandoned care homes, or are improving operating facilities.

This new wave has created the opportunity for individual investors to become part of the social care revolution. With investment levels typically in the £50,000-£100,000 range, this sector is accessible to most retirees with a pension pot.

For some it presents the opportunity to use their 25% tax-free draw-down in exchange for a fixed income which is much higher than an annuity. For others, it may make sense to release equity from a debt-free primary residence to ensure that assets are growing at a faster (and more predictable) rate than the currently stagnant housing market. For yet others, it may mean that some money released from selling a primary residence can be invested while the rest can be used to move abroad.

The returns from these investments range between 8-10% per annum, after costs, which is substantially higher than most other real-estate backed investments. This is a relatively low-risk investment given the demand described above. Importantly, it targets a sector which retirees understand. After all, we will all at some point need care.

With a fast-changing world, it is important that expat retirees consider not only ways in which they can efficiently manage their lifestyles abroad, but also protect their assets and sources of income in the UK. A combination of tax-free retirement abroad and fixed-income investments at home might just be the winning combination.

PORTUGAL: TAX HEAVEN TO TAX HELL?

by Luis Teixeira da SilvaPORTUGAL: TAX HEAVEN TO TAX HELL?

What a difference a week makes! A month, well that is life-changing. Three months, an eternity for tax.

As recently as six months ago, it was unquestionable that Portugal was among Europe’s best investment destinations. For seniors or retirees, it was the uncontested number 1: a growing economy; falling unemployment; a rapidly recovering real estate market; a real estate investment surge driven primarily by the very successful Golden Visa program; a wave of (mostly) wealthy foreign retiree immigration driven by the Non Habitual Resident program; and all this fuelled by 8 successive record-breaking years in the tourism industry.

However, since then, the government has insisted on a strategy of (not-so-gradual) assault on those perceived to be wealthy. And, unfortunately, as houses and apartments elicit a much more visceral response than pieces of paper known as shares or even a pile of intaglio paper known as money sitting in bank coffers, the government has set its sights firmly on ensuring that all those who own real estate pay for the right to bring investment into the country.

It started with what appeared to be a notion so ridiculous that it would be impossible to implement: taxing a “good” view. What was a good view? A sea view: definitely. A golf view: most probably. A country view: well, we know the countryside, under threat, may be considered a scarce resource. So that will probably come into play. Surely not a warehouse: well, under normal circumstances no one would think such an absurd thought. But these are not simply warehouses your house overlooks: they are refurbished historical buildings which are part of one of Europe’s most successful regeneration projects. So, yes, warehouses are probably in. In consulting it is called scope creep.

Now, all owners of real estate in Portugal know they will be taxed more via their IMI (municipal tax) but they have no idea of who decides, as least subjectively as possible, how good their view is. Is it perhaps too much of a coincidence that this increase comes at a time when many owners requested the official revaluation of their properties (only possible every 5 years) after falling construction prices, which saw a sudden drop in municipal tax revenue?

That followed closely on ongoing chatter that inheritance tax would be implemented in the next budget. A strong call for wealth redistribution pervades the conversation and as the long-suffering Portuguese citizen is well aware, when a rumour hits the airwaves, it is certain that the details are already being ironed out.

Then came the wealth tax. Weeks in the publishing, but one suspects cooked to perfection over a long period of time. An absolute uproar that a far left party had made a “suggestion” about taxing property. But within days it was hailed as a constitutional breakthrough eschewing the principles of equality.

Surely, all wealth would be taxed in the same way? Wrong, only property.

But what about property that had debt on it and which was being repaid by the owner? The answer was swift: everyone knows that official property values are well below actual property values. It seems that the members of parliament have not yet had the chance to visit one of the many golf course developments scattered around the country where frequently the opposite occurs.

But what if my neighbour owns stocks, shares and stockpiles his cash? Clever neighbour indeed…

Who will it affect? The “wealthy” of course. Anyone with real estate worth more than €600,000 (double the exemption for married couples).

What about primary residences? First and second homes will be exempt, was the government’s first response. One week later, an announcement that a sliding scale mechanism would be implemented, with no first and second home exemptions.

Our prediction: the exemption limit will fall to €500,000 and the government will embark on an upward home revaluation program.

While investors and owners rushed to legalise or register their investment properties under the AL (local lodging) law, spurred on by a threat of prosecution and a legion of tax advisory and consulting firms eager to capitulate on a new revenue stream, the “dark” side of the law began to emerge:

- the government can charge CGT on what is now considered a business, if you decided to cancel your AL license;

- a continued prejudicial regime favouring short-term lettings over long-term lettings, the latter subject to an effective tax rate of around 7 times that of short-term letting (although recent changes now mean that this difference is only around 2.5 times);

- a creeping up of IMI based on the notion of “lettable” properties (which conveniently were now easily identifiable by virtue of their registration under AL);

- and the latest uncertainty which has assailed owners who are not, despite what the government may say, professional landlords: the apparent need to withhold government taxes, in addition to dealing with VAT, for values over €10,000 per annum, meaning complex accounting which is contrary to the “simplified” regime which was launched as a motif for the law.

Add to this the fact that the country will almost certainly implement a IHT or inheritance tax (and even those who have gifted assets in life are under threat of IHT being applied retrospectively), and in six months Portugal has seen uncertainty caused by a change of the real estate fiscal environment on parallel with Brexit in the UK.

With all this going on, it is no surprise that until some sense of stability or normality returns, clients looking to make the most of the positive personal taxation environment will continue to seek long-term rental solutions that currently do not have any of the disadvantages of a property purchase.